food sales tax in pa

By law sales from eating establishments. This page describes the taxability of food and meals in Pennsylvania including catering and grocery food.

Pin By Msuptown On Bridal Shower Fruit In Season Brunch Buffet Catering Menu

6 Sale of food and beverages at or from a school or church.

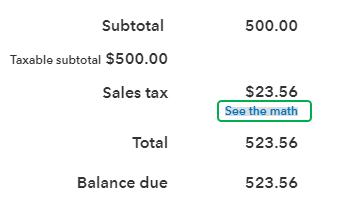

. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Pennsylvania sales tax. This license would apply only where the department has inspection authority. When calculating the sales tax for this purchase Steve applies the 6 tax rate for Pennsylvania with no other forms of sales tax due to Pennsylvania not having city county or local sales tax applications.

See the Retailers Information Guide REV-717 or the more detailed Taxability Lists for a taxable items to review subjectivity to sales tax of goods and services. The exemption for food products and meals sold at educational institutions dates back to the adoption of the sales tax in 1947 PA 47-228. By law a 1 percent local tax is added to purchases made in Allegheny County and 2 percent local tax is added to purchases made in Philadelphia.

The Pennsylvania sales tax rate is 6 percent. Twenty-five percent or greater real fruit juice is. State sales tax rates and food drug exemptions as of january 1 2021 5 includes a statewide 125 tax levied by local governments in utah.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 8. I Schools and churches. Juice is food but its either taxable or not taxable depending on the percentage of real fruit juice it contains.

31 rows Norristown PA Sales Tax Rate. To learn more see a full list of taxable and tax-exempt items in Pennsylvania. Keep track of your sales of cold food items.

Depending on local municipalities the total tax rate can be as high as 8. Penn Hills PA Sales Tax Rate. The Pennsylvania state sales tax rate is 6 and the average PA sales tax after local surtaxes is 634.

The Pennsylvania sales tax rate is 6 percent. Some examples of items which the state exempts from tax charges are certain medical prescriptions some items used in the agricultural industry cable television services meals or foodstuff used in furnishing meals for. Generally the sale of food or beverages by a school or church is exempt from tax if the sales are in the ordinary course of the activities of the school or church.

Baked goods such as cookies muffins cakes pastries and breads are subject to PA sales tax ONLY when sold by an eating establishment The term eating establishment is defined as. Allegheny county has local sales tax of 1 on top of the pa sales tax rate that totals 7. For More Information Reg arding Act 106Retail Food Facility Licenses For More Inform tion Regard ing Sales Tax L cen se.

Pennsylvania is one of the few states with a single statewide sales tax which businesses are required to file and remit electronically. B Three states levy mandatory statewide local add-on sales taxes. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda.

This includes food sold by an establishment selling ready-to-eat food for consumption on or off the premises on a take-out or to-go basis or delivered to the purchaser or consumer. A business or an identifiable location within a business which advertises or holds itself out to the public as being engaged in the sale of prepared or. The pennsylvania state sales tax rate is 6 and the average pa sales tax after local surtaxes is 634.

The sale of food and nonalcoholic beverages - by a caterer or eating establishment in Pennsylvania is subject to tax regardless of whether the customer is dining in or taking out. Sales Tax Exemptions in Pennsylvania In Pennsylvania certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. If this rule applies to you and you do not separately track sales of cold food products sold for take-out 100 of your sales are taxable.

Thus the total cost of sales tax is 371 2100 sales tax. PA Department of Agriculture 717 787-4315 Harrisburg PA Department of Revenue 717 787-1064 - Harrisburg. Meals and prepared foods are generally taxable in Pennsylvania.

31 rows The state sales tax rate in Pennsylvania is 6000. While Pennsylvanias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. This Pennsylvania sales tax exemption for manufacturing also applies to repair parts for.

SALES TAX IN THE RESTAURANT INDUSTRY WHAT IS TAXABLE. Baked goods such as cookies muffins cakes pastries and breads are subject to PA sales tax ONLY when sold by an eating establishment The term eating establishment is defined as. The legislative history of the act does not provide any insight into the rationale for this particular exemption.

Generally tax is imposed on food and beverages for consumption on or off the premises or on a take-out or to go basis or delivered to the purchaser or consumer when purchased from a caterer or an eating establishment from which ready-to-eat foods and beverages are sold such as a restaurant cafe lunch counter private or social club tavern. Pennsylvania sales tax exemptions for manufacturing offer both manufacturers and processors an exemption on purchases of tangible personal property including machinery and equipment predominantly used directly in manufacturing or processing operations per PA Code 3232. The 8080 rule applies when 80 of your sales are food and 80 of the food you sell is taxable.

California 1 Utah 125 and Virginia 1. The sale of food or beverage items by D from the restaurant is subject to tax. We include these in their state sales tax.

There are no transcripts of the House debate and the Senate transcript is incomplete. The Pennsylvania PA state sales tax rate is currently 6. Food prepared in a private home may be used or offered for human consumption in a retail food facility if the following apply.

How To Register For A Sales Tax Permit Taxjar

Pennsylvania Sales Tax Small Business Guide Truic

Understanding California S Sales Tax

Solved Should I Enter My Sales Tax As An Expense Every Time I Pay It Or Is That Automatically Figured Into My Profit And Loss Statement From The Sales Tax Program

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Center For State Tax Policy Tax Foundation

Local Peeps We Just Were Invited From Park City Diner Lancaster Knight Day Diner Lititz To Take Part In Their S O S Sharin Supportive Sos Park City

Is Food Taxable In Pennsylvania Taxjar

Sales Tax Holidays Politically Expedient But Poor Tax Policy

2020 Sales Tax Holiday Plastic Drop Cloth Hurricane Supplies Disaster Prep

Sales Tax On Grocery Items Taxjar

Understanding California S Sales Tax

How To Charge Sales Tax In The Us 2022

Pa Unemployment Base Year Chart Sales Taxes In The United States 350 275 Of Best Of Pa Unempl Tax Sales Tax Chart

How To Charge Your Customers The Correct Sales Tax Rates

What Is Sales Tax A Complete Guide Taxjar